what is personal check verification

The personal check is the type thats likely familiar to most banking customers. Its important for the hotel management to proactively verify all checks.

There are a number of different methods that can be used to provide the service these include checking different databases with negative or account history checking.

. What Is a Personal Check. Over 80 of them use a check verification service. A check verification service provides businesses or individuals with either the ability to check the validity of the actual check or draft being presented or the ability to verify the history of the account holder or both.

The person writing the check has the authority to write checks on that account. Treasury checks that are older than 13-months old will not be available in this application. Part of your DPX program our eCheck verification service provides.

What Is a Personal Check. With few exceptions most checking accounts still allow you to purchase personal checks you can. If your business accepts checks from customers regularly contacting banks for every check is not practical.

The process of certifying a check verifies. In simple words PIV Personal Identity Verification can be stated as a multi-factor authentication solution that covers the entire identity lifecycle from identity proofing to secure credential issuance physical. Verification that items remain unmodified from the electronic original.

With check verification services from Q-Check you can once again feel comfortable accepting personal checks. If theyre cashed unknowingly the hotel could be held responsible for the funds. Fraudulent checks can pose a significant threat to Hotel banksfinancial institutions.

Instead those services flag accounts and people who have a history of. You can replenish your account at any time with a credit card. Using these educational and professional verification checks as part of your pre-employment background screening process will make it easier to find the best person for the job.

Our solution presents businesses small and large with several different methods of verifying account holder information account validity and whether funds are available at the time of verification to cover the amount presented on the Check. A cheque operates as a mandate or authority to the drawees bank to pay the party named as drawer and debit the account of its customer the drawer. The signature is a legitimate signature.

Automated check verification services can help you figure out if youre likely to get paid but they dont necessarily verify recent account balances. Take the Check to the Bank. Using a pre-paid virtual terminal each time you verify a check in a located account through the BetterCheck system your balance is reduced by 25 to 50 depending on your price plan.

The check itself is legitimate and hasnt been washed or chemically treated. All Q-Check software has check verification by phone built in to it. Others will opt for check guarantee the assurance that even if the check bounces the sale will hold the merchant will get paid and the consumer will be given another chance to make good.

Verification is basically professional advice that works best for some merchants but they will need to conduct their own collections if a check fails. When you use a debit card to make a payment the funds are removed immediately. Have you ever wondered what type of check service most of the major retailers in the malls use to protect themselves against bad check losses then you have come to the right page.

Personal Identity Verification PIV is a NIST FIPS 201-2 security standard that establishes a framework for multi-factor authentication MFA using a smartcard. Treasury checks can be verified provided that the financial institution has a valid routing transit number check number and check amount. The only catch is.

Verification checks are a powerful way to defend against lies or half-truths. The Bills of Exchange Act 1882 however provides that a cheque may be crossed. The best way to protect yourself when bad checks are common or just too expensive is to use a check verification service.

Personal checks are not tied to savings accounts. Purpose of Personal Check Verification Processing. A professional license verification report will give you several pieces of information about the candidates license including both the date of issuance and the date of expiration.

The account is active and in good standing. If the check was given to you for a purchase have the writer of the check accompany you to the bank and make sure that you either have cash or have exchanged the check for certified funds before you. It is useful to look at these dates to know whether the candidates license is expired or whether it will expire soon.

Confirmation that the eCheck was issued by an authorized party. Personal checks are slips of paper from your banking institution that allow you to denote a specific amount of money to be removed from your checking account. Issue information for US.

On the check you write an amount of money and the name of the recipient who will receive that money. Check Verification - How It Works. These checks should not be cashed by your institution since they are no longer.

Those services help you identify bad checks by checking several databases before you accept the check as payment you run the check through a check reader or punch in the routing and account number online. Check Verification offers a wide array of Check Verification options which allow merchants to reduce both check returns and fraud. Treasury Check Verification System.

Check Verification Services. If you know how to write a check you can write one to a business or individual the payee for any amount you need to pay. The merchant is free to.

A personal check is a slip of paper thats processed from your checking account. Cheques are essentially negotiable instruments and may be negotiated by indorsement. They use check verification to stop upfront the habitual bad check writer from attempting to make a purchase in their store by first.

Proof of critical check data such as payee and amount. While these checks are not tied to other accounts other people can write checks if the account holder allows them. Taking the check to the bank it is drawn on to present it for payment is the most direct way to verify funds.

A personal check is a check that allows funds to be drawn from your account. When a customer pays by check simply enter the check information into the system and click on the button for check verification.

Verification Within A Week How To Gain Confidence Information Overload Background Check

Can You Recover Deleted Google Account Take The 2 Steps Account Recovery Google Account Accounting

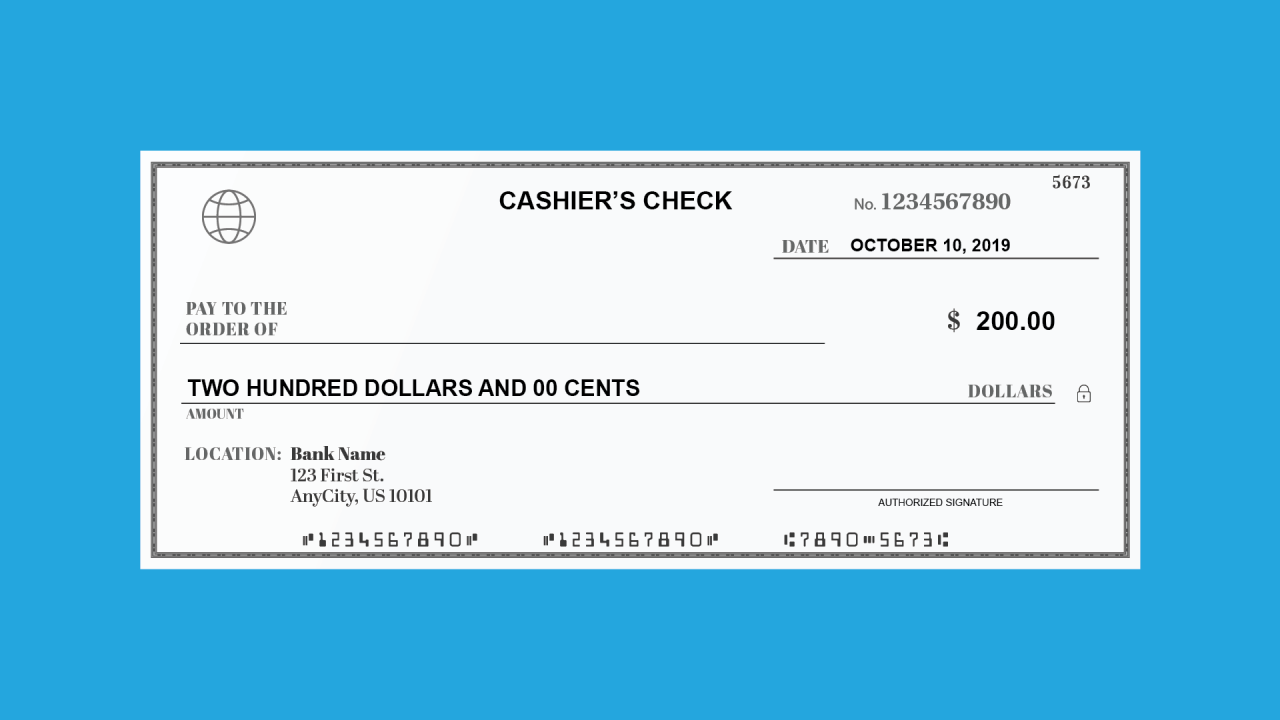

How To Verify A Cashier S Check 3 Precautions To Take Gobankingrates

Figma Email Verification Figma Helpful Email

Verification Of Employment Check More At Https Nationalgriefawarenessday Com 800 Verification Of E Letter Template Word Letter Of Employment Letter Templates

Paystubs Fake Template Earnings Proof Of Income Job Employment Verification Custom Printable Doctors Note Template Payroll Template Checklist Template

Php Email Verification Script Check Email Script Syntax

Job Verification Letter Check More At Https Nationalgriefawarenessday Com 15830 Job Verification L Letter Template Word Letter Of Employment Letter Templates

Fact Verification Checklist For Content Marketers Getting Information Wrong Can Ruin Content Marketing Content Marketing Institute Content Marketing Strategy

How To Verify A Cashier S Check 3 Precautions To Take Gobankingrates

Signed Personal Check Signed By Charles Manson To Stanley Etsy In 2022 Charles Manson Manson Charles

Approved Report Audit Business Report Graphic Verification Report Check Mark Icon Download On Iconfinder Icon Free Icon Set Graphic

Employment Verification Letter Letter Of Employment Samples Template Letter Of Employment Letter Template Word Employment Letter Sample

Browse Our Sample Of Verification Of Deposit Form Template Certificate Of Deposit Being A Landlord Money Management

Identity Verification In The Transport Industry Transportation Sector Identity Theft Digital Transformation